Mapping Decline and Recovery Across Industry Sectors

Different sectors enter and emerge from downturns at different times. A look at past recessions suggests how some industries may fare.

In an ideal world, every company would enter a recession led by a team of grizzled executives who could draw on their experiences of past downturns to guide it through the current one. Many companies don’t, however, and even for those that do, it can be difficult to rise above the crisis to ponder the lessons of history. Yet in a recession, developing accurate strategic plans is usually a high-stakes effort. False assumptions about the pace, scale, and timing of growth may slow progress in good times but could be fatal now.

Executives in an industry that lags behind the economy, for example, may imagine that they can avoid a downturn because at first the industry doesn’t slow down when the economy does. Other executives, failing to realize that their industries tend to revive before the overall economy, may plan too conservatively for the upturn. Decisions about acquisitions, divestitures, and even recruiting or retaining talent often hang in the balance.

To help executives sharpen their perspective, we looked at the financial performance of US companies during the four most recent recessions.1 Then we analyzed sector-level2 total returns to shareholders (TRS), revenue growth, and growth in earnings before interest, taxes, and amortization (EBITA) around the times of these downturns. Although such analyses can’t provide definitive parallels from one recession to the next (for obvious reasons, such as size, geographical reach, or origins), the general trends can prove invaluable in helping executives examine their assumptions about the future performance of an industry. We found that, so far at least, the current recession—despite claims of its being “unprecedented”—seems to be following many of the patterns that previous ones did.

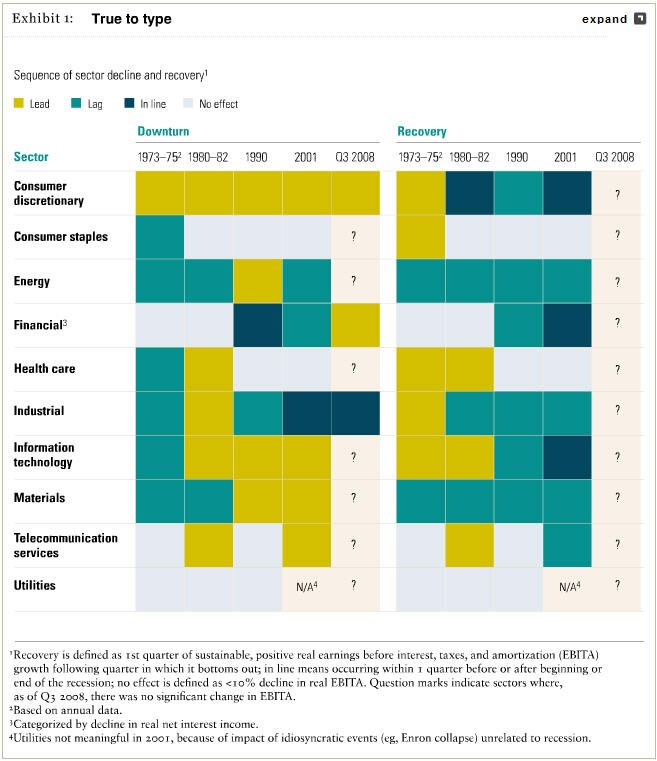

- Similar beginnings. The timing of contractions in sector-level sales and EBITA indicates that the four most recent recessions began with a core underlying shock that then spread through the economy in a fairly predictable way. All four began with falling sales and EBITA in the consumer discretionary sector, and three began with similar declines in the IT sector as well (Exhibit 1). By contrast, in three of the four, the energy sector was among the last to be hit. Some sectors have been fairly resistant to recessions: consumer staples wasn’t affected significantly in the last three, and the last two didn’t significantly affect health care.

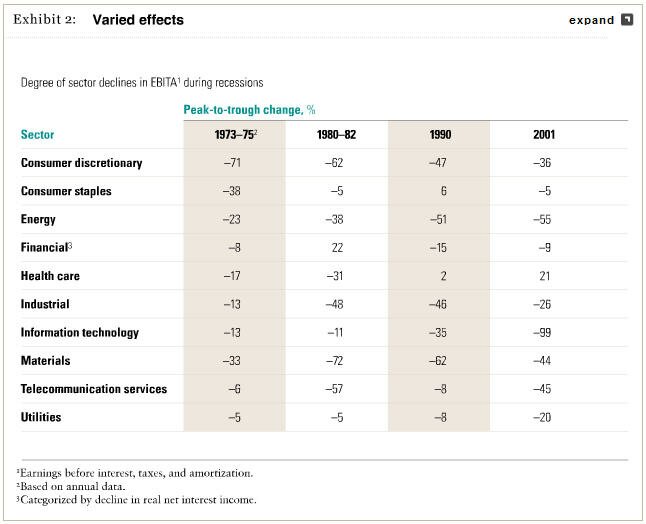

- Variable magnitude. The size of the contraction in EBITA varies across sectors (Exhibit 2). Generally, consumer discretionary, materials, energy, and industrials post the sharpest drops. The information technology sector has been more variable, with large drops during the past two recessions but smaller ones in 1973–75 and 1980–82. The most resilient sectors have been health care and consumer staples, whose revenues and EBITA fell relatively little in the majority of the previous recessions.

- The speed of decline and recovery. In almost every recession we studied, sectors contracted much more quickly than they recovered.3 Typically, it takes six to eight quarters for a sector’s EBITA to bottom out—fewer in 1973–75 and more in 1980–82. The time needed to get back to peak EBITA levels generally is not only much longer but also highly variable. It took the better part of a decade for many sectors to recover from the recession of the early 1980s. After the recession of 2001, however, it took just over two years for most sectors to recover their peak EBITA levels once they reached bottom. Some industries, such as telecommunications in 2001, never hit their peak levels again.

- Similarities in share price performance. Share prices tend to decline either before or just as a recession starts; rarely does a sector’s TRS begin to decline much later. As a result, the share price performance of different sectors during a recession tends to be more similar than their financial performance (Exhibit 3). Share prices also tend to rise in step near the end of a recession, in marked contrast to revenues and EBITA, which often lag behind significantly.

Overall, the impact of recessions on share prices has varied. During the 1973–75 downturn (and to a lesser extent, the 2001 one), share prices fell steeply, with many sectors suffering large losses; in 1973–75, for instance, all sectors but materials (which was down by 26 percent) lost more than a third of their value. In the 2001 recession, seven out of ten sectors lost more than 20 percent of their value. Sectors affected by “shocks” can fare even worse: IT and telecommunications each lost more than 75 percent of their value in the recession of 2001.

The 1980–82 and 1990–91 recessions affected valuations less severely. Only one sector lost more than a third of its value in either downturn (energy in 1980–82 and financials in 1990–91), and most sectors suffered losses of 5 to 15 percent.

The current recession seems to be following many patterns we observed in its predecessors. The consumer discretionary sector, which is sensitive to economic decline, has led in all of the past four recessions. It is also leading the current downturn, having posted the sector’s largest post-2001 drop in EBITA—almost 5 percent—during the second quarter of 2007, five months before the recession’s official start.4

In 2008, TRS fell significantly in nearly every sector, with all but consumer staples losing more than 20 percent of their value and seven losing more than a third of it.5 Given the historical patterns (and current headlines), revenues and EBITA can be expected to fall in most other sectors as the recession continues. These similarities give executives some idea of what to expect as they plan their next steps.

History also suggests some possible indicators of the beginning of a recovery. In three of the four most recent recessions, higher consumer discretionary and IT spending led the way. When real EBITA growth resumes in these sectors, it may be a useful indication that the economy is turning around. Also, TRS generally stops declining near the end of a recession, so resumed growth in broad stock market indices might also herald the end of the current one.

Notes

1The recessions we studied were those of November 1973–March 1975, January 1980–November 1982, July 1990–March 1991, and March 2001–November 2001. Technically, the 1980–82 downturn was two recessions: January 1980–July 1980 and July 1981–November 1982. For this analysis, we have combined the two.

2We grouped the companies in our sample into ten Global Industry Classification Standards (GICS) sectors.

3Of the 27 instances when we documented a decline in earnings before interest, taxes, and amortization (EBITA) due to a recession, 24 showed a drop in EBITA that was faster than the recovery.

4The National Bureau of Economic Research has dated the start of the current US recession as December 2007.

5The 2008 total returns to shareholders (TRS) measured as of November 30, 2008.

By: Tim Koller, Bin Jiang and Zane Williams

Source: McKinsey Quarterly

- March 3, 2009

- Finance and Accounting

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!