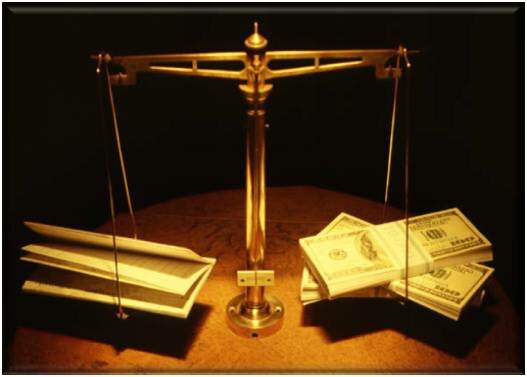

Venture Capital Investing Down More Than 50%

How should an entrepreneur respond to the fact that raising venture capital -- which has never been easy -- is getting harder now that funding levels are way down and now that the limited partner investors in venture capital funds are failing to make their capital call commitments?

Venture Capital investing is down 50% according to a recent Entrepreneur.com article:

Venture capital investing fell to $3.7 billion in the second quarter, down more than 50 percent from $7.6 billion in the year-ago period, according to the latest MoneyTree Report from PricewaterhouseCoopers. Although that second-quarter sum represented a 15 percent jump over the prior quarter, the number of deals remained flat at 603, PwC said.

Many sources--including big pension funds, college endowments, and, in some cases, high-net-worth individuals--have failed to meet commitments to some funds, making this one of the most challenging environments for venture capital since the dot-com bubble burst, says Howie Schwartz, a director at the FundingPost, a networking group for venture capitalists and entrepreneurs. "No one is admitting this, but we're seeing it anecdotally," he says.

What does this mean for entrepreneurs seeking venture capital?

- Be as creative as possible, because your likelihood of raising capital just went from 1 in 4,000 to 1 in 8,000

- Customer financing - get customers to prepay for your services to finance your working capital requirements

- Vendor financing - negotiate favorable terms from vendors or buy on consignment

- Venture development - launch a startup for a larger company with a predefined spin-in structure

- Narrow the focus - execute on only one part of the value chain and gain capabilities by using existing infrastructure rather than building capability: outsource, partner, barter, beg, borrow, swap work, license, etc. as opposed to building capability

- Invest through a 401(k) plan - form your own corporation and roll your 401(k) into it to capitalize your new company (more)

- Lease management - running a company in exchange for a share of the profits (more)

- If you do need to raise venture capital, be as prepared as possible: (for more information see our Raising Capital topic page and the Finance section of our Venture Academy DVD Training series)

- Improve your business plan by using the Venture Analysis

- Create a detailed financial model (more)

- Fully develop your product or service

- Have customers paying you for your product or service

- Develop a full sales pipeline of prospects

- Develop a very clear elevator pitch

- Develop a short and compelling PowerPoint investor presentation

- Research venture capital investors thoroughly to find the right fit in terms of:

-

- Their investment strategy

- Their geographic focus

- Their industry focus

- The size of their investments

- The stage and type of deals they invest in

- Their preferences for syndication

- The timing of their current fund

- Network your way into the firms that are a good fit

- Manage the investor pipeline like any other pipeline

- Consider hiring an expert capital raiser to raise the capital for you (more)

- May 22, 2010

- Raising Capital

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!