Market Timing and Stock Picking Are Not Effective Investment Strategies

More investing wisdom from Adam Smith Family Advisors…

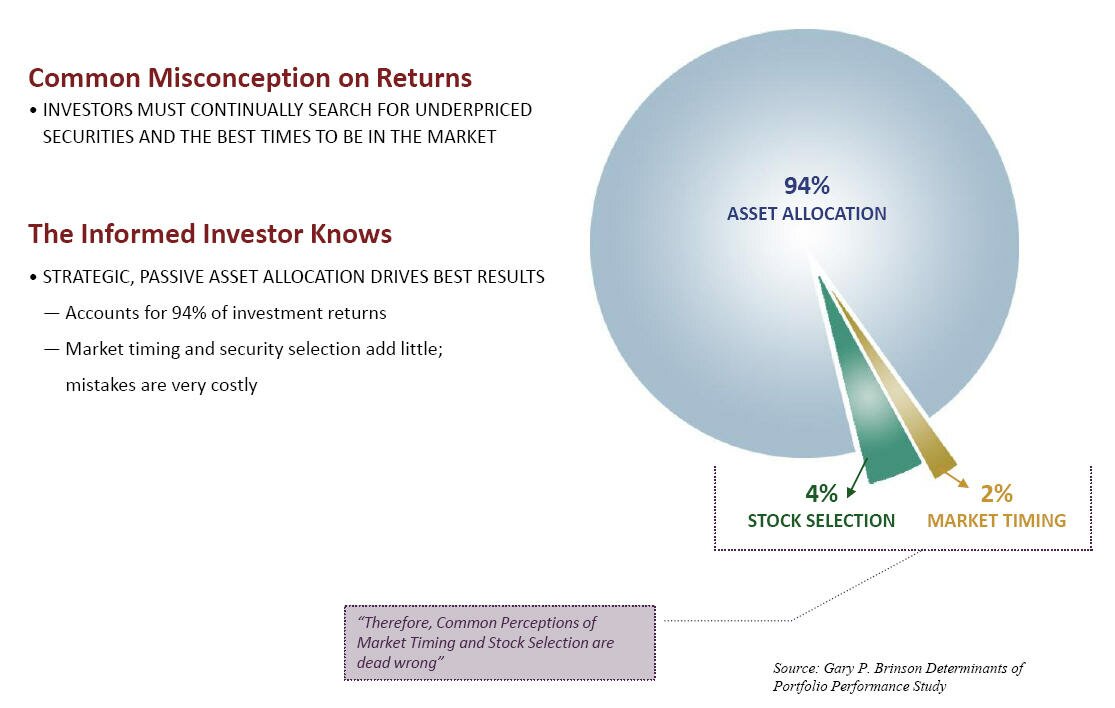

Asset allocation drives 94% of investment returns over time, while market timing and stock picking -- the focus of most brokerage firms and the financial media -- combined, only account for 6% of portfolio returns. Passive investing is the most efficient investment strategy. More and more investors (both institutional and individual) are realizing that active management is not the best way to invest. Warren Buffet (likely the greatest investor of all time) says, “Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees.” Passive investing reduces the “relative underperformance risk” of active management.

- December 17, 2010

- Investing

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!