Jobs, Jobs, Jobs: The Truth about Jobs

Obama talks about creating “jobs”. Politicians love to promise more “jobs”. Pundits worry about mergers destroying “jobs”. Workers don’t want “jobs” to move overseas. And on and on, ad nauseum. But only entrepreneurs and growing companies can add jobs. And only the best and most competitive workers will earn and keep those jobs. Jobs are not an entitlement and they are not a given. They are created, earned, and perhaps destroyed. And in a global economy -- if left unfettered and pure in a free market sort of way -- jobs will always flow to the lowest-cost labor and/or the highest valued output. Period. Anything else is simply mucking with the market and destroying value in the long term.

If politicians truly want to “create” jobs, they should merely set policy and pass laws that create the ideal context (lower taxes, less regulation, etc.) for the creation of jobs by the actual job creators and then just get out of the way. If not, guess what? Companies will continue to build new factories and create new jobs in more favorable environments. It’s that simple. Compete or die. And the U.S. is not competitive with other nations.

Here’s just one data point among many: The U.S. has the highest corporate tax rate. Want to know why (valued at $36.8 billion) moved its headquarters from the U.S. to Bermuda and then later to Ireland in terms of incorporation? Hint: last year the company had pre-tax profits of $2.9 billion. Here’s a bit of math:

If Accenture had continued to incorporate in Delaware in 2010 based upon its pretax profit, it would have paid $1.18 billion in taxes at the corporate tax rate of 40.7%. But in Ireland, the company would only paid $363 million at a corporate tax rate of only 12.5%. (Technically, the company actually paid more in taxes due to various subsidiaries and other tax jurisdictions, but to make the point, I am simplifying the situation). And with an earnings multiple of 12.7x, that means the decision to move to Ireland was worth $10.4 billion to Accenture (12.7 times the tax savings of $818 million). You would have moved your company to Ireland as well.

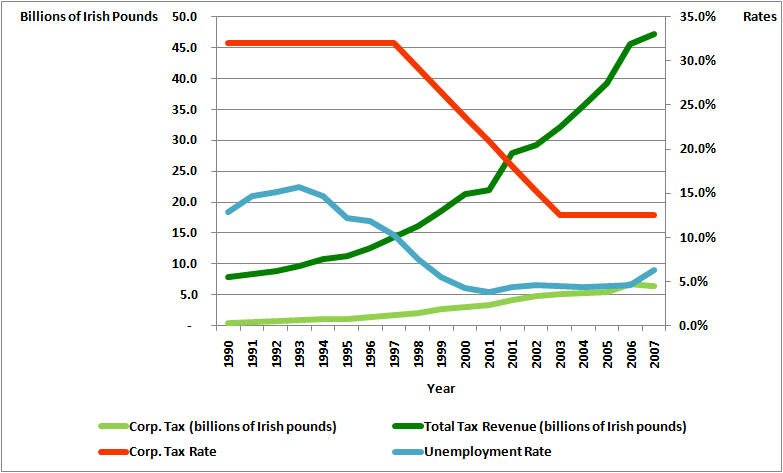

Oh, by the way, since I love analysis, I did a quick analysis of the impact on the Irish economy in the first five years since it lowered its corporate tax rate from 32% to only 12.5%. The new, lower rates were phased in starting in 1998 and took full effect in 2003 and here is what happened in Ireland:

Notice that not only did corporate taxes actually rise despite the drastic tax rate cut, but overall tax revenues rose and unemployment dropped like a rock from a high of 15.7% to only 3.9% - 4.6% and stayed there for several years. In the past few years, the Irish economy has faltered badly and they've made some key mistakes in other parts of their economic strategy, but the point is still clear in terms of overall national economic strategy: economies compete and one key lynch pin in terms of job creation is the corporate tax rate.

Oh, and one more point: the U.S. lost the corporate tax revenue that Accenture now pays to Ireland. While liberal politicians may believe that tax revenues will rise if they raise tax rates, that is not what actually happens. Instead, the law of unintended consequences kicks in and decisions are made to go elsewhere. Just like jobs flow to the lowest cost labor, company's tax dollars flow to the lowest rate tax jurisdiction.

- September 1, 2011

- Introduction to Entrepreneurship

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!