Institutional Equity Financing

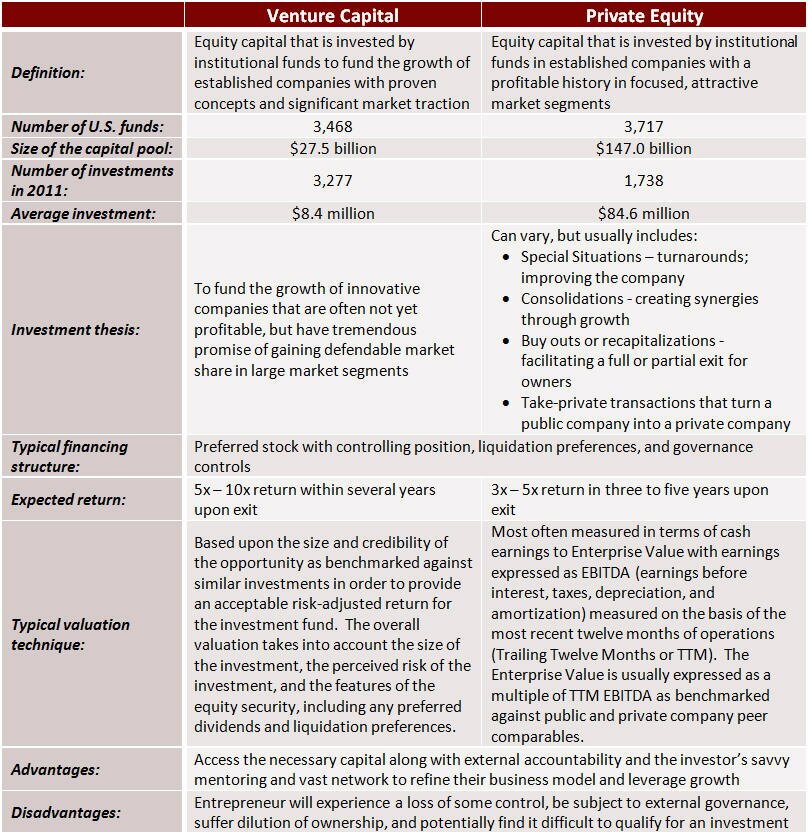

Equity Financing is usually invested based upon the future prospects of a company and the anticipation of a future exit event that will provide acceptable returns to the investment fund. At the Growth Stage, Equity Financing is typically in the form of growth-stage Venture Capital invested by institutional venture capital firms, and at the Middle Market stage, Equity Financing is typically in the form of Private Equity invested by institutional private equity firms. There are also 571 active corporate investment arms that are identifiable that actively make corporate investments in smaller companies as a part of their growth strategy and strategic alliance efforts. See the table below for a detailed summary of the various aspects of institutional equity financing. (Angel investing is far more informal and makes it hard to find really good data on the sector.)

- Institutional Investment Funds: Both types of firms are typically organized as general partnerships with the investment professionals as the General Partners (GPs) and the investors in the fund as Limited Partners (LPs).

- General Partners: The GPs of the firms are the investment professionals that select the investment opportunities through a rigorous process of opportunity analysis and due diligence. The GPs then shepherd those investments (having a fiduciary responsibility to their LPs), over a period of years through their role as board members and advisors to senior management. Their ongoing role provides mentoring, board governance, and a vast network of contacts and relationships to their portfolio companies in an effort to protect and grow the value of their investment.

- Limited Partners: The LP investors in these funds tend to be investors with large pools of capital, such as retirement and pension funds, university endowment funds, insurance companies, and wealthy family offices. The institutional investment fund investors allocate a portion of their capital to alternative investments in asset classes that include Venture Capital and Private Equity in an attempt to realize higher risk-adjusted returns than the public stock market.

- Institutional Investment Strategies: Venture Capital and Private Equity firms have agreed-upon investment strategies with their LP investors. This maintains their risk profile and potential returns; maintains a consistent process and staff leverage; reduces their due diligence time to investigate a potential investment; and increases their ability to leverage their industry expertise, talent network, and business partner network. These investment strategies will play a large part in their interest in a particular investment and usually include the following items:

-

- Industry or Type of Business – The firms will always have a specific industry or group of industries and/or certain types of businesses as a focus for their investments, such as “software”, “medical technology”, or “manufacturing”.

- Geography – Many firms also have specific geographic areas of focus for their investments – especially Venture Capital firms – which also helps reduce their travel time to portfolio companies.

- Size – Nearly all firms have specific investment amounts that they invest in any one deal, such as “$1 million - $2 million per company” or “up to $25 million per company”.

- Stage and type of deal – Nearly all firms have a specific stage and type of deal focus for their investments such as “seed capital” or “growth capital” or “buy-out capital”.

- Syndication of deal – Most firms have a specific strategy for how they approach investments in terms of working with other investment firms such as “co-investor”, “lead investor”, or “controlling position”.

- Timing – All firms have timing cycles that they follow in terms of a fund life and stage that affects their ability or willingness to make investments. For example, if a firm is at the end of a current fund’s life and is busy marketing to investors to raise a new fund, they will not have the time, willingness, or even capital to make an investment. Conversely, if a firm has recently raised a fund, their willingness to invest will be high and they will usually aggressively pursue opportunities to build momentum.

- Success Tips: Because there are thousands of Venture Capital and Private Equity firms with varying investment strategies and capabilities, it can be a daunting task for a management team to sort through – which is why many companies use an intermediary such as an investment banker to source institutional investments for them. In an attempt to help cut through the complexity, here are several success tips:

-

- Review a firm’s website and their stated investment strategy prior to making contact and only approach firms whose investment strategy fit your geographic location, your industry, the size of your capital need, and your company’s stage.

- Do not approach firms whose stated investment strategy is to only co-invest with a lead investor, because they cannot lead the investment process on their own.

- Review a firm’s website and their announcements (if any) of when they raised their current fund to discern where they are at in their fund life prior to making contact and do not approach firms that are at the end of their fund life (this can be a hard one for management teams to discern on their own without industry databases).

- Carefully review their current portfolio companies (usually posted on their website) to look for competitive conflicts with your company, as that could be a deal killer. Alternatively, look for an opportunity to potentially combine your company with one of their portfolio companies.

- July 11, 2012

- Raising Capital

Mahatma Ghandi September 30, 2012

Hello,

We offer the following kinds of loans and many more;

* Personal Loans ( Unsecured Loan)

* Business Loans ( Unsecured Loan)

* Consolidation Loan

* Combination Loan

* Home Improvement, and many more...

Apply now, and stop all worries about loan.

All loans @ 6.8% interest rate and fast in processing

We look forward to serve you better.

Regards

Mahatma G

Director For Finance

ADIF LOAN INC

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!