How to Grow Your Business in a Downturn - Part 2

In Part 1 of this series, we looked at three tectonic shifts that define our current context. In this post, we will look at two insights based upon rigorous analysis of what happens before, during, and after a recession.

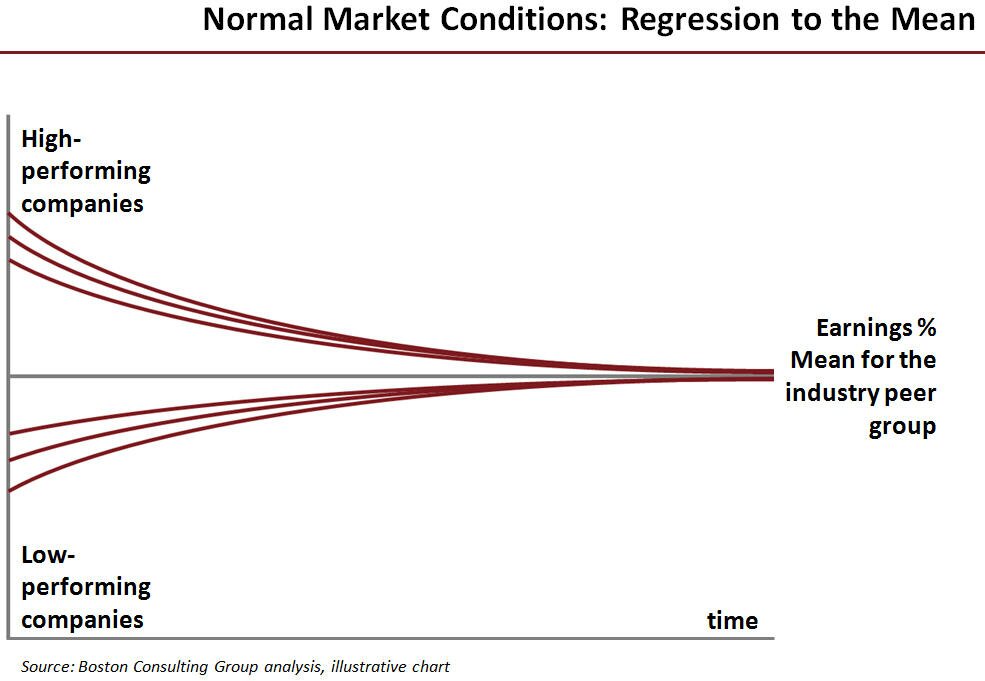

Insight #1 – According to analysis by the Boston Consulting Group, under normal conditions the earnings of companies in industry peer groups tended to regress to the mean over the long-term. If one company was highly profitable, new and/or incumbent companies copied what they did and their advantages were competed away - and their earnings regressed to the industry average. If another company was underperforming, it either failed or was acquired out of its misery, raising the overall average of the peer group - and again their earnings regressed to the mean.

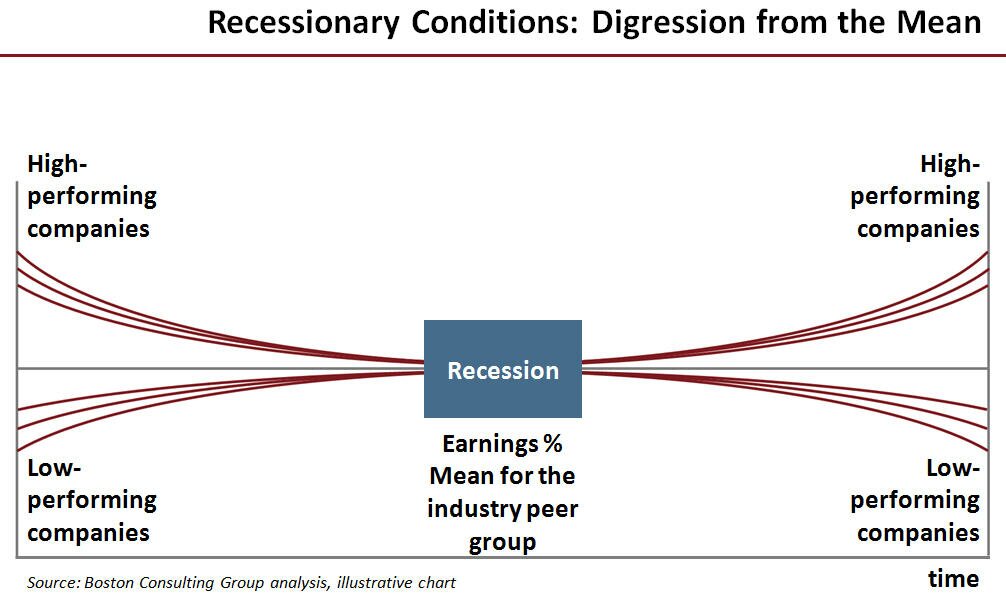

Insight #2 – Interestingly enough, according to recent research from Boston Consulting Group and corroborating research by the Harvard Business School, during a recession, companies that were at performance parity prior to the recession actually digress from the mean due to their decisions during the recession. And not only is there digression, but the separation of winners and losers is staggering and lasts throughout the recession and for several years later, creating a massive performance gap - all based upon the divergent actions those companies took.

Let’s take a look at what happens with peer companies that had similar earnings levels going into a recession:

The losers:

- 85% of market leaders lost their position

- 80% of companies were not able to ever again achieve their historical growth rates

- 40% were not able to regain the same levels of Revenue and Earnings they once had, let alone any growth

- 17% did not even survive the recession

The winners:

- 85% of markets were led by new leaders

- 9% of all of the companies actually came out of the recession stronger than when they entered the recession

The winners not only won during the recession, but they were able to sustain their advantage…

…they outperformed in Revenue and Earnings by about 100% for 3 full years after the recession ended…

…and they still held a 34% advantage for a full 5 years after the recession was over

Now that we've laid out the three tectonic shifts in our current context and two insights into what happens before, during, and after a recession, we will look at the stresses in our current recession to get a sense for the crucible that will cast your company’s destiny. Continue on to Part 3 of this series...

- October 2, 2012

- Strategy

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!