Help! I Keep Losing Money In My Business

Question

I have a small owner/operator business where I offer five different services to my customer base: retail, rental, repair, onsite service work and storage. It is very difficult to manage my business month-to-month because it seems like its feast or famine with more “famine” months than “feast” months. I also feel unfocused and I am not sure what I should do to improve the bottom line. All of this has led to a lot of difficulty in our personal finances and home life as we struggle with bills and have had to declare bankruptcy a few years ago. Now we are struggling to make the trustee payment and keep up with our ongoing bills. Any suggestions?Answer

The situation you are in is common and is encountered by many small business owners. The good news is that there is clear and decisive action that you can take. Overall it is very difficult as a lone owner/operator to balance sales and delivery (see this link for more on that), so you will need to balance your time investment in sales and growth and focus on the most profitable part of your business in order to keep the revenue coming in and drive up profitability. You will also want to pay attention to your home budget to drive down those expenses to gain more cushion between the business income and the home expenses.

I would recommend the following steps:

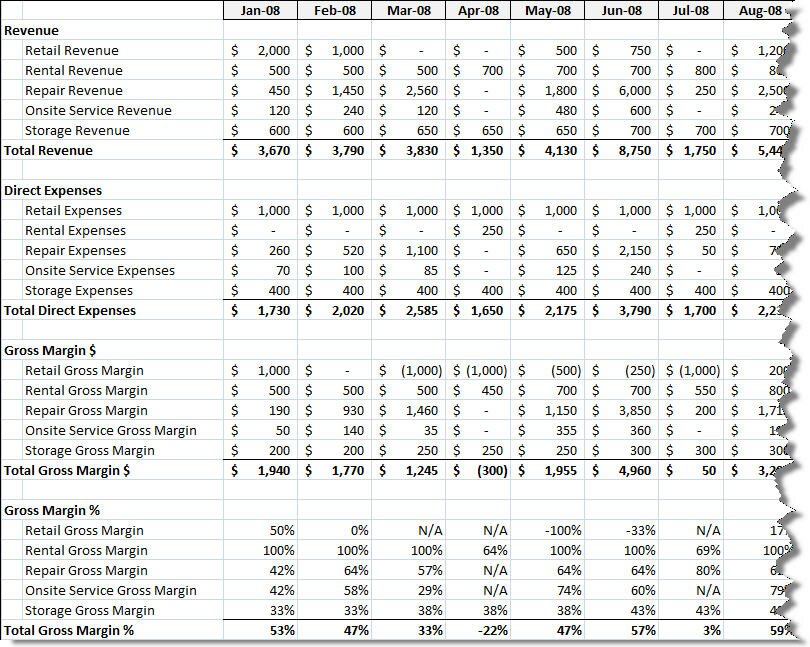

- Put together a historical trend analysis of the last 24 – 36 months as follows that includes revenue, all Direct Expenses and Gross Margin by product line (the phrase "product line" is used generically whether it is a product or a service that you offer) to help isolate which of the products are profitable and which are not. If there are expenses that would typically be allocated to overhead or indirect expenses, but clearly exist for only one product (such as the lease on the retail store front), go ahead and allocate it under direct expenses for the purposes of creating your product line profitability analysis. Your analysis should look something like this when you are done:

- Analyze the results to figure out which of your product lines are unprofitable or less profitable than the others. This will help you focus your business on the most profitable part of your business. In the made up example above, I would shut down the retail part of the business because the sales are too inconsistent to cover the monthly lease expense. Do not be afraid to raise prices as needed to fix your margin problems or even shut down parts of your business if needed.

- Analyze your Cash Cycle for each product line to make sure you are maximizing your cash flow, e.g. you will want to charge a large up-front deposit on repair work to help fund the purchase of the repair parts.

- Keep track of the source of all of your customers by product line and then increase your marketing efforts on the best sources of your most profitable product lines. This will help you grow your most profitable product line via the most productive means of growth. Be sure to manage your sales pipeline (more on that here) to move your prospects turned up by your marketing efforts into paying customers as quickly as possible.

- All of this analysis is at the Gross Margin level, but we are focusing on that to increase your gross margin enough to contribute to your Overhead and Indirect Expenses sufficiently to give you positive Net Income each month. You should also look at all of your overhead and indirect expenses, such as insurance, professional services fees, and other general businesses expenses for the entire business to see if you can lower any of those expenses.

- Scrub your home and personal budget to take out as much expense as possible to buy yourself more margin and cushion each month. If you do not have a family budget, you need to create one. You should have a plan for your business and a budget for your family so you can sync up and manage your life with less stress.

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!