How to Facilitate a Fast, Low-Cost Investment in Your Company

I get many requests and questions from entrepreneurs about how to raise capital and it is a difficult process to be sure (see these various posts and downloads to learn more about the overall process.)

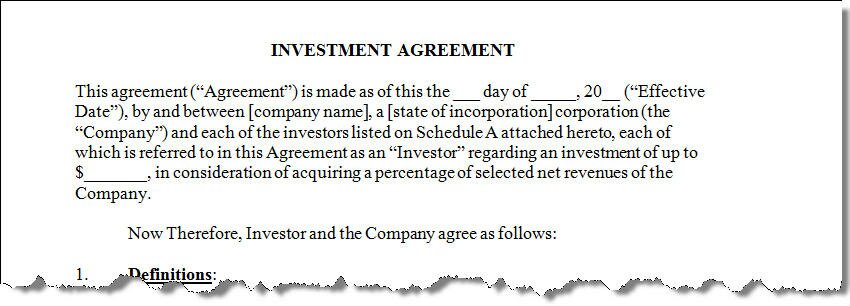

One creative way to raise capital -- and keep all of your ownership and control -- is to raise capital with a royalty-based investment agreement. This is a good tool to use for relatively small amounts of capital from friendly angel investors in a very inexpensive fashion. While a typical institutional venture capital investment carries a lot of time and expense -- usually around $25k to $50k just to have the attorneys complete the legal documents to "paper" the deal -- and carries with it tons of issues of control and governance, etc., a royalty-based investment greatly simplies the investment agreement by paying the investor a royalty in exchange for their investment. (It's no small wonder that most VC firms need to invest $1 million or more just to cover all of the deal "friction" costs.)

The key negotiable items on a royalty-based investment agreement include:

- The size of the investment

- The percentage of the royalty

- The frequency and timing of the payments

- The total payment cap

- The time limitations

I just helped a young software company that I advise close an investment of $100k of badly-needed capital to get them to the next stage in only a few days from the time I penciled out the bullets points to when the attorney (for only $2,500) wrote up the final agreement and the investor signed it.

You can purchase and download the straight-forward 6-page agreement for only $10 and save $2,490...

P.S. Be sure to negotiate carefully and have your attorney review the document prior to signing the final agreement.

- August 5, 2010

- Raising Capital

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!