How to Grow Your Business in a Downturn - Part 4

In Part 1 of this series, we looked at three tectonic shifts that define our current context, in Part 2, we looked at two insights based upon rigorous analysis of what happens before, during, and after a recession, and in Part 3 we looked at the stresses in our current recession to get a sense for the crucible that will cast your company’s destiny. In this post, we will look at the winning strategy.

The good news is that the past is an effective tool for understanding the present and the analysis clearly indicates what the winners did to win during a recession. And, importantly the winners all took remarkably similar actions during all six recessions and across all industries and in both countries analyzed in separate studies by the Boston Consulting Group and Harvard Business School.

First, let’s look at the six metrics that were available for all 6,590 public companies in the analysis that tell us the story of the actions taken:

- The number of employees

- The cost of goods sold as a percentage of sales (COGS)

- Sales, general, and administrative expenditures (SG&A)

- Research and development expenditures (R&D)

- Capital expenditures (CapEx)

- Plant, property, and equipment stock (PP&E)

Now let’s look at the specific actions taken during a recession and what it led to…

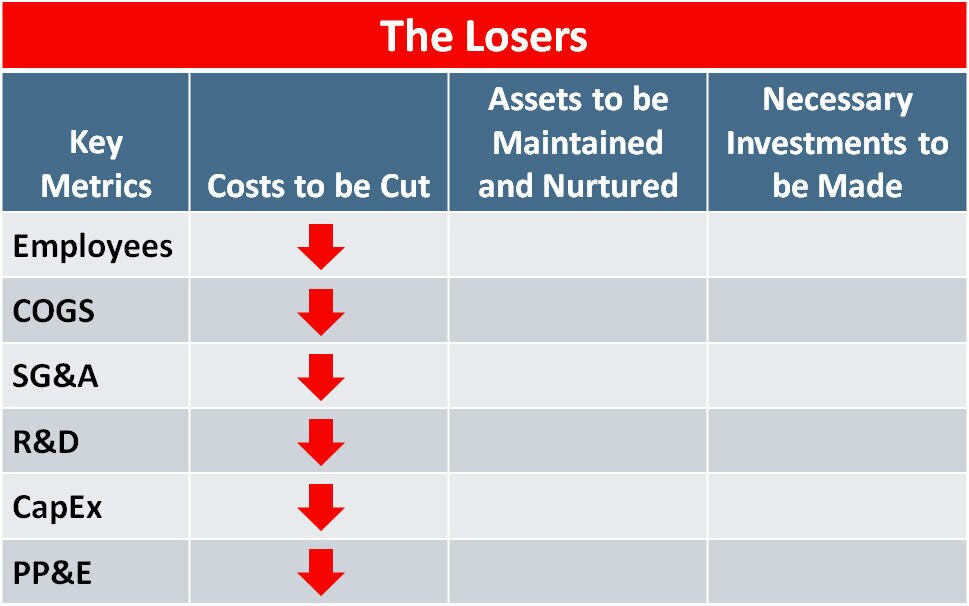

The Losers – for the most part – looked at all of these items as costs to be cut and went on the defensive:

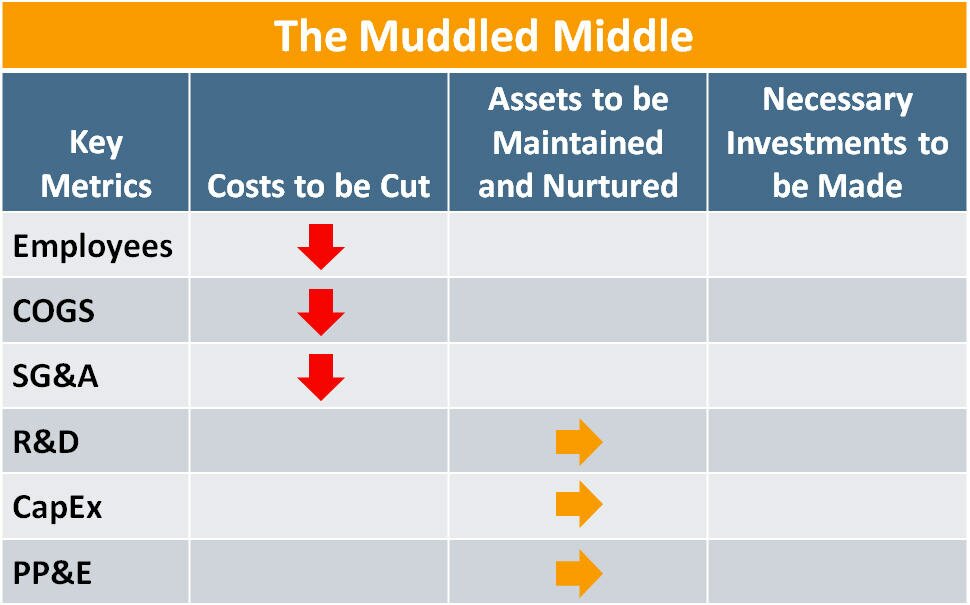

The Muddled Middle as I call them, were mixed in how they viewed the items and cut some and maintained levels in others compared to peers:

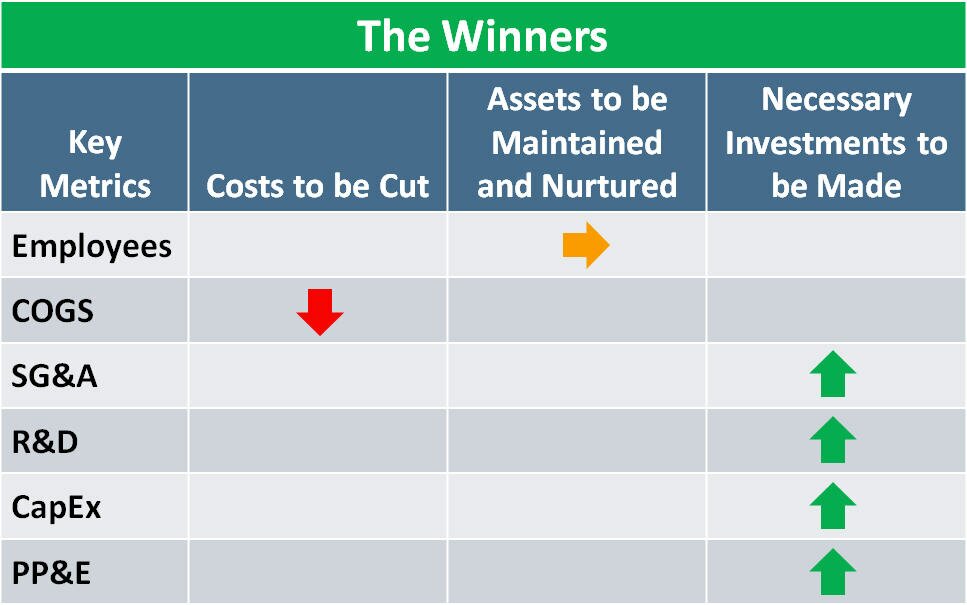

The Winners were very clear:

- They kept employees that were considered strategic assets

- They aggressively managed down cost of goods sold (by supplier negotiations and efficiency gains), and

- They viewed everything else as strategic growth investments: The Sales and Marketing portion of SG&A, R&D, CapEx, and PP&E

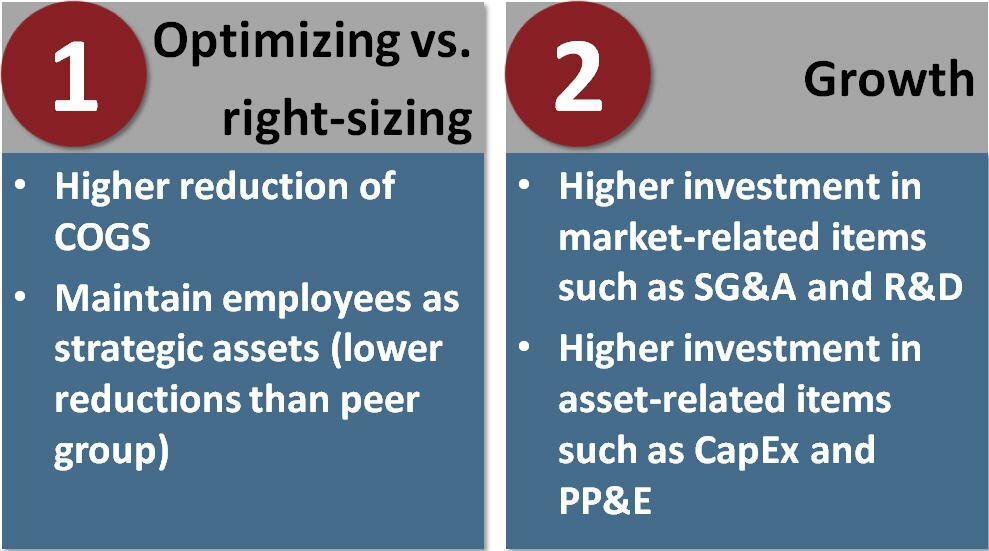

And the order in which the winners did this was important. First, they optimized and then they focused on growth:

And, an aggressive growth strategy can be preemptive. The analysis showed that bold companies that forged ahead rendered similar investments by competitors less attractive.

Now the Boston Consulting Group and Harvard analysis ends there by telling us what to do to win: “invest aggressively in growth in the teeth of a recession”.

But this begs an entire array of new questions of "how" to grow, which we will look at in our next post. Continue on to Part 5 of this series.

- October 15, 2012

- Strategy

Please login to post a comment.

Member Log In

Register Now

Register now to gain access to all of the resources available on our site. Basic membership is free!